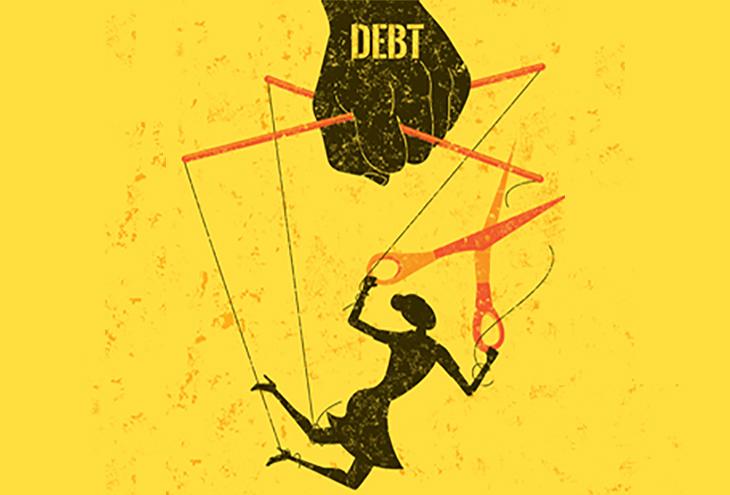

The student debt crisis has been in the headlines lately, and for good reason. Student loans are now second only to mortgages as the country’s principal category of consumer debt. There are more than 44 million student borrowers with a total of $1.45 trillion in debt — the average graduate from the class of 2016 entered the workforce with more than $37,000 in student loans.

Managing major academic and financial responsibilities is a big challenge, and few graduates make it through college without both taking out loans and working part time. Financial pressures can be a key reason why students fall behind on credits, get lower grades, and take longer to graduate. When it takes more time to get through school, students end up paying more in tuition — often racking up more credits than they need and shouldering additional debt.

SAVVY FINANCIAL STRATEGIES

But here’s the good news: as you balance competing priorities on your way to your college diploma, there are solid strategies you can use to control debt. “The smartest approach is to do everything you can to maximize your non-loan financial aid while minimizing your costs — both before and during college,” advises John F. Wasik, author of The Debt-Free Degree.

Above all, it’s important to remember that you’re in charge. “Never give up power over your finances,” says Andrew Josuweit, CEO of Student Loan Hero. “Take advice from people you trust, but they won’t bear the costs of borrowing like you will.”

The decisions you make about the college costs you incur and the student debt you acquire will stay with you, so it’s important to be informed from the start. Here are decisions with financial implications that you should take seriously.

BE STRATEGIC ABOUT THE SCHOOL AND MAJOR YOU CHOOSE

If you’re still shopping for college, experts agree that it’s smart to look for schools that offer generous grants, tuition discounts, and scholarships, some of which may be earmarked for students from underrepresented communities. If you’re thinking a big-name school is a better choice than a lesser-known institution, take a levelheaded look not only at the tuition but also the other costs — including room and board or any commuting expenses, books, and supplies.

And consider the financial benefit of attending college in your home state. According to the College Board, one year of in-state tuition at a public four-year college is approximately $9,410, compared with $23,890 for out-of-state tuition.

Another possibility is attending one of the growing number of colleges that have dropped all loans from their financial aid packages. Mark Kantrowitz, publisher and vice president of strategy at cappex.com, points out that there are now 15 such institutions in the U.S., and that more than 50 colleges have eliminated loans in aid packages for low-income students.

Also think about the academic program you pursue. “Degree programs that lead to relatively higher salaries and good job prospects are worth investigating,” says Wasik. “It may even make sense to take on debt for some programs because their higher starting salaries will allow you to pay off your loans more easily.” Wasik recommends looking at the long-term career outlooks published by the Bureau of Labor Statistics, which continue to show promising prospects for STEM professionals.

BE STRATEGIC ABOUT YOUR CREDIT HOURS

Every credit hour you take is an investment. According to Department of Education tuition data, the average cost for each credit hour toward a 120-credit-hour undergraduate degree is approximately $594 — that’s $71,335 per degree. The analysis by Student Loan Hero found that average credit-hour costs at four and two-year public colleges were $325 and $135, respectively, and at four- and two-year private schools, $1,039 and $557, respectively.

What you pay per credit can inform a broader money-saving strategy. The same Student Loan Hero study found that by earning their first 60 credits at a community college, students saved an average of $54,659 on their undergraduate educations.

It’s also important to consider the impact of course load on graduation rates. Research shows that students who consistently take a full-time course load — 15 credits per semester — are most likely to graduate on time. But many so-called full-time students are not taking the courses needed for an on-time degree.

One challenge is registering for a course load that’s (1) manageable in the context of your other responsibilities and (2) will get you to graduation sooner rather than later. Some experts advise that taking a full course load can give students a financial edge because when they finish college sooner, they avoid additional college costs — and they can begin collecting a paycheck sooner. A study by the Community College Research Center at Columbia University found that college students who signed up for 15 credit hours — rather than the more common 12 — paid between 10 percent and 20 percent less in tuition and fees by the time they earned their degrees.

BE STRATEGIC ABOUT LIFE BALANCE

The authors of the Columbia study acknowledge that work and family obligations outside college can constrain students’ ability to take a full course load as well as their ability to do their best in class. As with so many things in life, it’s a balancing act.

The authors of the Columbia study acknowledge that work and family obligations outside college can constrain students’ ability to take a full course load as well as their ability to do their best in class. As with so many things in life, it’s a balancing act.

Before you take on a job, investigate Federal Work-Study opportunities. Like scholarships and grants, work-study is a type of financial aid that doesn’t have to be repaid. Eligible students make at least the federal minimum wage, and many employers are willing to work around your school schedule. There are limits to how much money you can earn through work-study, but it’s a possibility to explore.

If you’re managing both school and work, there are some common-sense guidelines. Financial aid specialist Katie Wornek emphasizes the importance of following a regular routine with steady sleep habits and staying organized. “Whether you use a day planner or set reminders on your phone, it’s important to keep track of your responsibilities,” she cautions. “Try to plan as far in advance as possible.”

And don’t go it alone — having a support network such as an AISES Chapter or study group can be a great way to stay connected while you take on the world. It’s also important to know when to ask for help. The student services office should have resources that can help you manage stress and keep your various priorities in perspective.

On the upside, maintaining a dual track of work and study can establish habits that will serve you for the rest of your life. And if you can get a part-time job in your field, you’ll have an opportunity to network, add some muscle to your resume, and prepare to hit the ground running with that diploma.

BE STRATEGIC ABOUT MANAGING STUDENT DEBT

If you make an educated decision to take out a student loan — or more than one — keep careful track. Student loan specialist Kantrowitz advises that total college debt should not exceed your total annual income after graduation. Another rule of thumb: take out no more debt than you can repay in 10 years. Follow that guidance and you can end up with payments that are less than 10 percent of your monthly income before taxes.

When payback time gets close, don’t panic. Take an inventory of what you owe and mark the due dates on your calendar. Experts recommend setting up regular, automated loan payments so that you can build your credit history. And look into your borrower benefits: some lenders will reduce your interest rate if you sign up for automated payments. In addition, if your lender offers a payment grace period after you graduate, take it. You can begin to set aside monthly payments during those six to 12 months, and have some extra funds ready.

BE STRATEGIC ABOUT REPAYMENT

Financial professionals recommend speed-ing up repayment if possible. “One of the biggest changes I implemented right away was demolishing my student loans through extra monthly payments,” explains Student Loan Hero’s Josuweit, who’s free of debt after owing more than $107,000. “Over the years, I consistently overpaid my loans to reduce the principal, pay down debt faster, and save money on interest.” If you decide to pursue this tactic, first see if there are prepayment penalties in your lender’s fine print.

If you ever become concerned that you can’t make payments regularly, discuss your options, like an extended repayment plan, with your lender. There are also ways to consolidate loans, through either a federal consolidation loan or a private lender. And if an unexpected setback occurs, you can look into loan deferment or forbearance — but if you don’t make interest payments, that interest will accrue and be added to your total debt, so these are important decisions that hopefully you won’t have to make.

You should also know that, in certain cases, borrowers are able to qualify for loan forgiveness. One program is Public Service Loan Forgiveness, which releases the obligation to repay federal Direct Loans for graduates who’ve made 120 qualifying monthly payments while working for a government or not-for-profit organization.

While there are options to change repayment terms in some cases, at the end of the day, the goal is to emerge from college with as little debt as possible, with a wealth of career and earning opportunities. Less debt means greater peace of mind in your future. It all begins with becoming informed, managing your time and money thoughtfully, and staying focused on earning your diploma.